Back to 2015 Annual Meeting

Insurance Coverage for Massive Weight Loss Panniculectomy: A National Survey and Implications for Policy

Stephanie E. Dreifuss, MD, J. Peter Rubin, MD.

University of Pittsburgh, Pittsburgh, PA, USA.

BACKGROUND

As rates of morbid obesity and bariatric surgery grow, an increasing number of patients seek panniculectomies to correct their redundant skin and reduce their risks of physical limitations and medical complications. As more patients require panniculectomies, however, their access may be limited by unclear or unreasonable insurance policies.

Currently, panniculectomy coverage guidelines are developed by insurance companies, while surgeons have limited input as to what policies are fair to doctors and patients. Here, for the first time, we have surveyed plastic surgeons nationally to determine their opinions on which criteria are clear, reasonable, and accessible. This data could guide policy-making and impact patients seeking massive weight loss surgery.

METHODS

Panniculectomy coverage criteria were compiled for third party payers making up the largest market share (Highmark, Cigna, and Aetna). These criteria were consolidated into general summary criteria, and a survey using these criteria was created and distributed to all members of the American Society of Plastic Surgeons (ASPS) assessing three characteristics of each criterion - clarity, accessibility, and reasonability.

Average scores for these three characteristics were calculated for each summary criterion, and these average scores were used to determine an overall rank for each criterion. Additionally, the number of insurance policies requiring each criterion was determined.

RESULTS

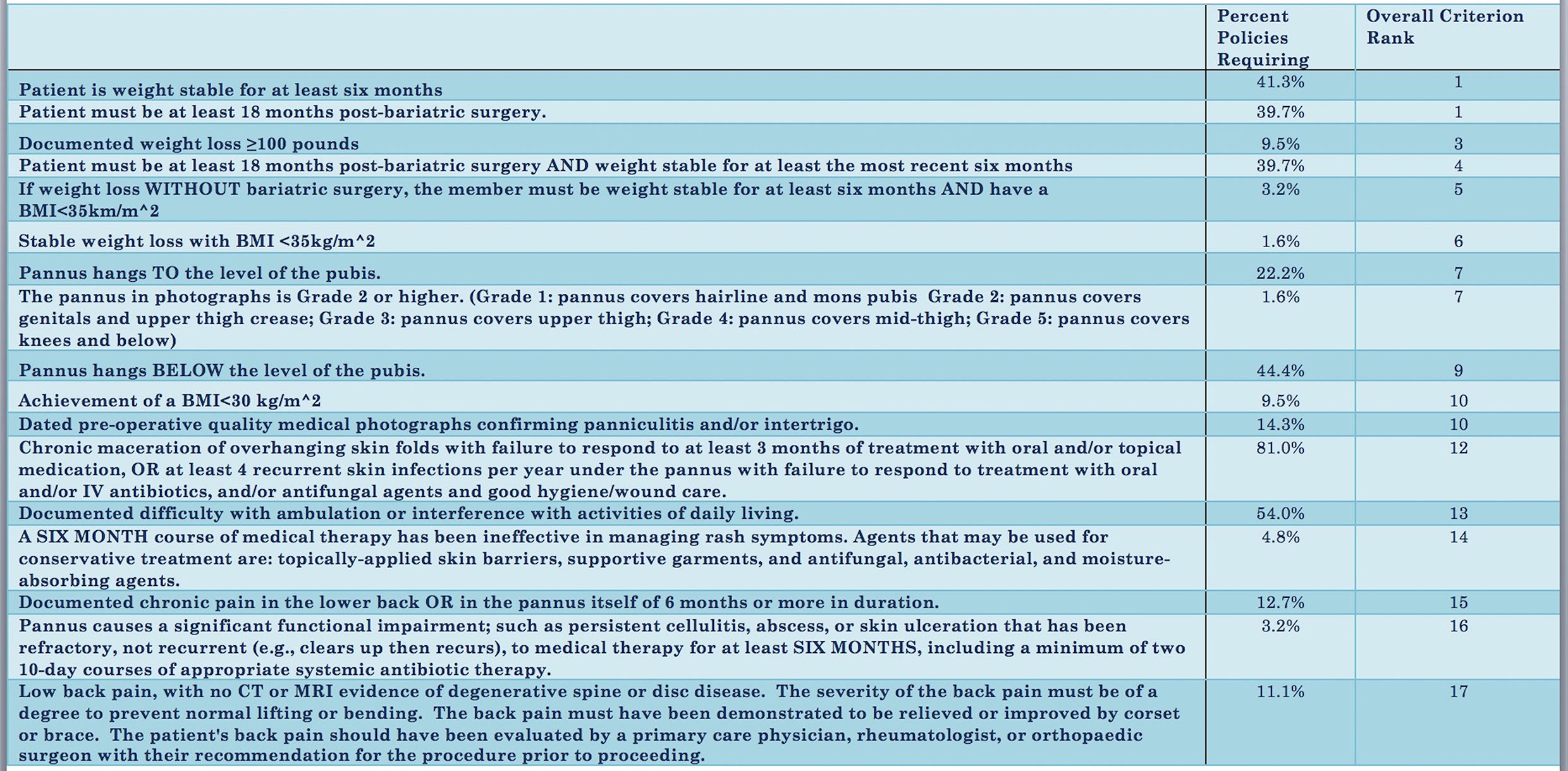

Criteria were collected from 63 insurance policies. 172 distinct criteria were identified, and these were condensed into 17 summary criteria. Surveys were distributed to 7,400 members of ASPS, and 450 responses were obtained.

Based on survey data, the highest ranking criteria were: "Patient is weight stable for at least six months" and "Patient must be at least 18 months post-bariatric surgery." These criteria were required by 41.3% and 39.7% of insurance providers respectively (Figure 1). The lowest ranking criterion was: "Low back pain, with no CT or MRI evidence of degenerative spine or disc disease." This was used as an exclusion criterion by 11.1% of insurance providers.

The most common requirement from third party payers was: "Chronic maceration of skin folds with failure to respond to at least three months of treatment with oral or topical medication." This was necessary for coverage by 81.0% of providers. However, based on survey data, this criteria ranked 12th in clarity, accessibility, and reasonability. The least common were: "Stable weight loss with BMI<35" and "The pannus . . . covers the genitals and upper thigh crease." These were each required by only one insurance policy and were assigned overall ranks of 6th and 7th respectively.

CONCLUSIONS

Here, we present a physician assessment of insurance criteria for the coverage of panniculectomy - a procedure for which demand continues to grow. Given the variability in scores for clarity, accessibility, and reasonability, we conclude that more physician involvement in guideline development may be beneficial. Future work will poll the opinions of bariatric surgeons for a more comprehensive view on the fairness of panniculectomy coverage policies.

Back to 2015 Annual Meeting

|